Against Monopoly

defending the right to innovate

Monopoly corrupts. Absolute monopoly corrupts absolutely.

Copyright Notice: We don't think much of copyright, so you can do what you want with the content on this blog. Of course we are hungry for publicity, so we would be pleased if you avoided plagiarism and gave us credit for what we have written. We encourage you not to impose copyright restrictions on your "derivative" works, but we won't try to stop you. For the legally or statist minded, you can consider yourself subject to a Creative Commons Attribution License.

current posts | more recent posts | earlier posts

Fifteen minutes of fame

[Posted at 10/26/2008 08:36 AM by David K. Levine on Against IM  comments(0)]

comments(0)]

Latest TIIP is out

[Posted at 10/26/2008 08:30 AM by David K. Levine on Innovation  comments(0)]

comments(0)]

Off topic for your amusement

[Posted at 10/17/2008 07:59 PM by David K. Levine on The State and IP  comments(1)]

comments(1)]

Under the dark of night

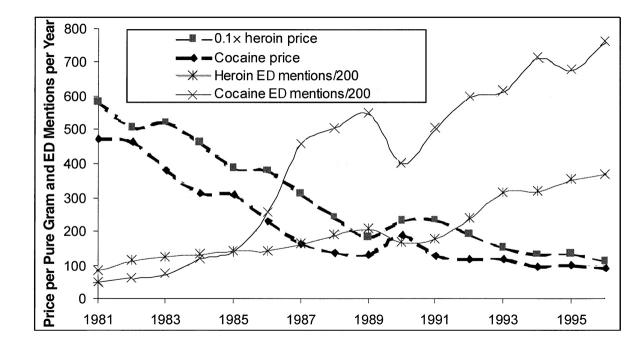

(graph from the American Journal of Public Health)

The position of drug czar was created in 1982 (according to Wikipedia). The dark lines are the prices of cocaine and heroin which have been falling ever since. Does the creation of a "czar" position mean that they have given up hope?

Addendum: There is something else interesting in that graph. One industry that operates entirely without the "benefit" of patents and copyright is the illegal drug industry. Yet it is a very innovative industry. For starters, as can be seen in the graph, prices have dropped quite a bit - over 15 years by a factor of about 5 (a little more allowing for inflation). Few industries can match that. And we know that there have been significant innovations: the invention of crystal methamphetamine; rock cocaine; stronger strains of marijuana and so forth. And presumably there have been innovations in methods of smuggling drugs into the country. Clearly these have been widely imitated. Which brings up the question: maybe if the government legalized recreational drugs, but subjected them to the same type of patent restrictions as ordinary pharmaceutical products - the price would go up instead of down?

[Posted at 10/13/2008 07:43 PM by David K. Levine on IP in the News  comments(10)]

comments(10)]

Shouldn't they have read the bill

(The vote was at 1:30 pm Eastern time.)

Addendum on credibility: We were repeatedly told that various bad things would happen if the bailout bill was not passed by a certain date, usually tomorrow or next Monday. The banking system would collapse. ATMs would stop working. Firms would stop be able to meet payroll. None of those things ever happened. One of the promised bad things was the collapse of the Asian stock market which woke up a week ago on Monday, saw that no bill was yet passed and survived. The house turned down the bill later in the day; the Asian market survived again. Today...Monday October 6, after the bill passed...the headline is "Asian markets plunge on crisis fears."

[Posted at 10/03/2008 02:02 PM by David K. Levine on Against Monopoly  comments(0)]

comments(0)]

What I really think of the bailout bill.

[Posted at 10/02/2008 08:59 AM by David K. Levine on Against Monopoly  comments(7)]

comments(7)]

I've seen everything now

I have a new much cheaper bailout plan: let's take $100 billion, and give an equal share to every member of the House of Representatives who agrees to give half of it away tax-free. Those that have investment bankers on their backs can give it to them; those that want to help people who can't pay their mortgages can give it them. That should get all of them off our backs.

Alternatively, let's revert to the original Poulson plan with an additional clause that the personal taxes of all the economists that signed the letter opposing the bailout will be cut to zero. That should get us off their backs.

[Posted at 10/01/2008 04:48 PM by David K. Levine on Against Monopoly  comments(1)]

comments(1)]

Crisis and Bailout

Everyone knows that the United States faces a serious financial crisis and that the Administration is asking for an astoundingly large sum of money to fix the problem. Fewer may know what economists think about the crisis. Most academic economists - the economists who do not work for companies likely to benefit from the bailout, nor for the President - are opposed to this plan. This large group of experts has wide ranging political opinions, and includes democrats, republicans, and most likely some libertarians. So: why is there a crisis, what is this plan, and why are a large number of academic economists opposed to it?

...

The bottom line, in the immediate future, is this. The Federal Reserve Bank and its sister agencies such as the Federal Deposit Insurance Corporation (FDIC) already have strong tools against a cascading failure of the banking system. They has been using those tools, including advancing credit to banks through the discount window, insuring deposits, and selectively allowing institutions to fail. We have seen isolated bank failures. There will be more in the future. We have not seen good banks fail, nor have we seen cascading failures. We have been given no reason to think anything of the sort is imminent. It is sad to say that despite this the U.S. Government is in a state of panic. Supposedly knowledgeable government officials talk as if ATMs might stop working and firms will not be able to meet their payrolls. This is utter nonsense. To debunk the obvious: Washington Mutual failed Thursday night. Washington Mutual ATM cards continue to function as usual. Individual and corporate bank accounts are federally insured up to $100,000 per bank. The normal process of bank closure does not prevent bank customers from accessing their funds. As to payroll: We do not doubt that some firms of various sizes are going to fail to meet payroll and go bankrupt in the next weeks. It is likely that a few of them would have been able to survive if credit was more widely available at the moment. But most firms do not meet payroll by short-term borrowing. The fact that banks are reluctant to lend to each other does not have much impact on their ability to make short term loans to customers. And so on.

No objective reading of data we have access to indicates anything near as bad as the claims that are being made. It may be that eventually more intervention than the Federal Reserve and Treasury can do without Congressional action will be needed. However, this is not a natural calamity or a war where there will be large and irreparable harm if we do not act immediately. There is adequate time for the public, the Congress, the Treasury and Federal Reserve to think through the alternatives carefully, to monitor the situation with equal care, and if necessary intervene in markets in a way that makes sense.

Public officials, especially the Chairman of the Federal Reserve Board have an obligation to explain these facts and reassure people that they are not in danger of a catastrophic collapse. It is rather unfortunate, then, the opposite seems to be occurring. For example, on September 24 Ben Bernanke declared in front of Congress:

All told, real gross domestic product is likely to expand at a pace appreciably below its potential rate in the second half of this year and then to gradually pick up as financial markets return to more-normal functioning and the housing contraction runs its course. Given the extraordinary circumstances, greater-than-normal uncertainty surrounds any forecast of the pace of activity. In particular, the intensification of financial stress in recent weeks, which will make lenders still more cautious about extending credit to households and business, could prove a significant further drag on growth. The downside risks to the outlook thus remain a significant concern. ...Over time, a number of factors should promote the return of our economy to higher levels of employment and sustainable growth with price stability, including the stimulus being provided by monetary policy, lower oil and commodity prices, increasing stability in the mortgage and housing markets, and the natural recuperative powers of our economy. However, stabilization of our financial system is an essential precondition for economic recovery. I urge the Congress to act quickly to address the grave threats to financial stability that we currently face. For its part, the Federal Open Market Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability.

Roughly speaking he said "things are not too bad, but gradually getting worse, and you better act quickly to give us $700 billion to fix it." The conclusion does not seem to follow. It is not surprising that people imagine that there is far more catastrophic information that he is not telling us. If the Federal Reserve Bank and Treasury in fact have information that things are worse than Bernanke reported they should tell us what it is. Otherwise they should stand up and make it clear that doomsday is not around the corner.

[Posted at 09/30/2008 04:26 PM by Michele Boldrin and David K. Levine on Against Monopoly  comments(6)]

comments(6)]

Continuing Madness

I've now read it in a manner of speaking. It does not seem that different than the original bill. He gets $350 billion with no questions asked which he can do pretty much as he pleases with, with another $350 if he asks and Congress does not veto it within 10 days or 15 days, depending on which part of page 51 you believe. The oversight provisions appear weak with actual oversight being done entirely by the executive branch plus the chairman of the Fed. The congressionally appointed "oversight" committee seems to be limited to writing a report about regulatory reform. The Treasury which has been backstopping money market funds - not a bad idea under the current circumstances - now seems to be prohibited from doing so. There are some modest provisions about CEO compensation, workouts for homeowners, and authorization to operate a security insurance program.

The basic objection to the bill is it is likely to cost a lot of money without accomplishing a great deal. That isn't solved in the details. Beyond that, the bill is surprisingly weak in the details. My interpretation is that this is that Treasury got what they wanted, with a bunch of rhetoric and cosmetic stuff put in so that Congress can say they got the taxpayer a better deal.

[Posted at 09/28/2008 04:48 PM by David K. Levine on Against Monopoly  comments(0)]

comments(0)]

Panic

Yes: there can be cascading bank failures and that is a bad thing. But it does not happen instantly, not tomorrow, not next week, not next month. Here is a graph of bank failures during the Great Depression which we supposedly face again if we don't approve this ridiculous plan immediately.

I got this from a publication of the Federal Reserve Board. The point of the graph is simple: the banking system didn't fail all at once during at the beginning of the Great Depression: there was a continuing series of bank failures stretching over years. Meaning that there was plenty of time to think through a policy response. And it bears emphasis: at the beginning of the Great Depression the Federal Reserve did exactly the wrong thing: it failed to provide liquidity to the system and allowed the money supply to contract. It is the documentation of this in the Monetary History of the United States for which Milton Friedman and Anna J. Schwartz are justly famed. At the moment the Federal Reserve has been carefully, and largely quietly, doing exactly what it is supposed to do - namely exactly the opposite of what it did at the beginning of the Great Depression.

Let's be clear: the only casualty of having a sensible and rational debate about how big the problem is and what needs to be done will be the Congressional vacation - and only for members of the relevant committees at that. Maybe if they think this is a $700 billion dollar problem and a possible Great Depression they should consider canceling that? I really can't think of a worse reason for a policy blunder of this magnitude than Congress was eager to take a break.

Come on folks: get a grip.

[Posted at 09/27/2008 04:06 PM by David K. Levine on Against Monopoly  comments(10)]

comments(10)]

Most Recent Comments